- Corey Cohen

- Mar 10

- 2 min read

It used to be the ultimate guarantee to have a lease with the federal government. These days in Washington, D.C., long centered around federal employment, there's upheaval as Musk’s Department of Government Efficiency (DOGE) slashes office leases and prepares to sell off government properties nationwide.

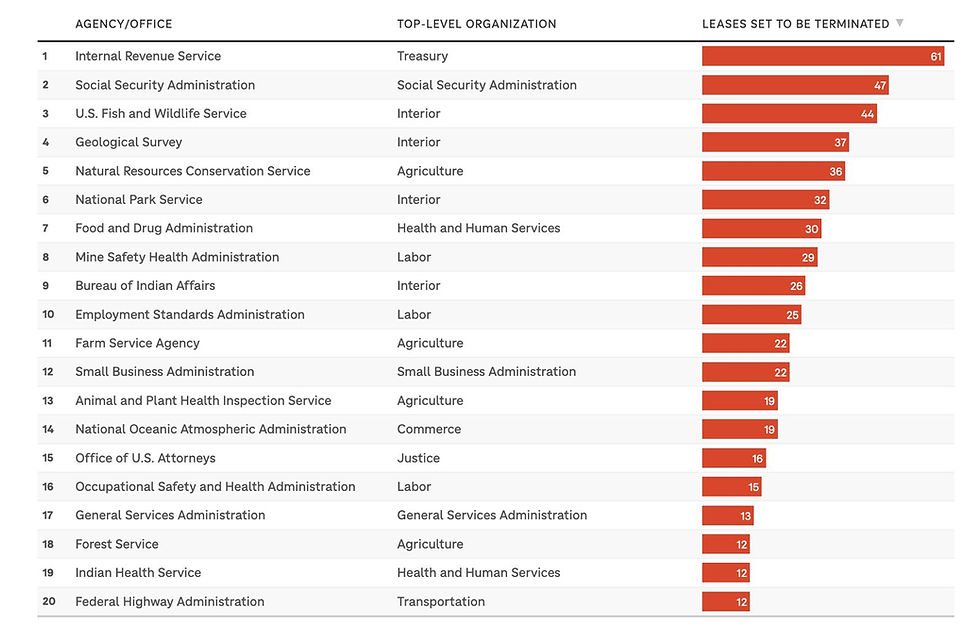

Since February, DOGE has canceled hundreds of leases across major cities. NPR reported that more than $100 million in savings resulted from terminating leases, while DOGE assured federal workers that "plenty of available office space" remains. The most dramatic move came last Tuesday when the General Services Administration (GSA) listed 443 federal properties—totaling 80 million square feet—for sale, only to remove the list a day later. NPR analysis indicates the government is preparing to shed up to a quarter of its 360 million square feet of real estate.

South Florida: A Market in Flux

DOGE’s cuts are rippling through South Florida, where federal buildings in Miami and West Palm Beach may hit the market. The Real Deal noted that the David W. Dyer Federal Building, leased to Miami Dade College, briefly appeared on the GSA’s now-removed list. Some see opportunities in prime locations, while others fear lease terminations will further strain an already weak office market.

Potential redevelopment sites include Brickell Bay Plaza, a nine-story federal building in Miami’s financial hub, and a Social Security Administration building near Vanderbilt University’s planned expansion in West Palm Beach.

Legal and Market Challenges

Landlords may challenge lease cancellations, citing penalties for early termination. Additionally, before private sales, properties must first be offered for public use or sold to local governments. Commercial Observer reported that some experts argue these buildings would have fetched higher prices during the 2021 real estate boom.

What’s Next?

DOGE has introduced programs like Space Match to sublet underused offices rather than vacate them outright. However, with Musk’s unpredictable downsizing, the federal real estate market is in flux. The process has been marked by confusion, errors, and shifting lists of targeted buildings. NPR reported that this week, the GSA even posted—then deleted—a list of "non-core" properties, which included federal courthouses, the Justice Department headquarters, and even the GSA's own offices. Those who adapt quickly - especially Tenants in need of more space or are on the move - may benefit from one of the biggest shake-ups in government real estate history.

On the move in 2025? We’re always here to facilitate smooth transactions for Buyers, Sellers, Landlords, and Tenants alike.

Best,

Corey Cohen

Founder

The Roebling Group

646.939.7375

@mrcoreycohen

Comments